Through the terrorism pool, insurers can reinsure the risk of claims for eligible terrorism losses by entering into a Terrorism Reinsurance Agreement (Reinsurance Agreement) with ARPC. Eligible contracts of insurance are defined in the Terrorism and Cyclone Insurance Act 2003 (TCI Act). The policyholders of eligible insurance contracts will be covered for eligible terrorism losses in the event of a declared terrorist incident (DTI), with insurer customers required to meet these claims in accordance with the other terms and conditions of individual policies.

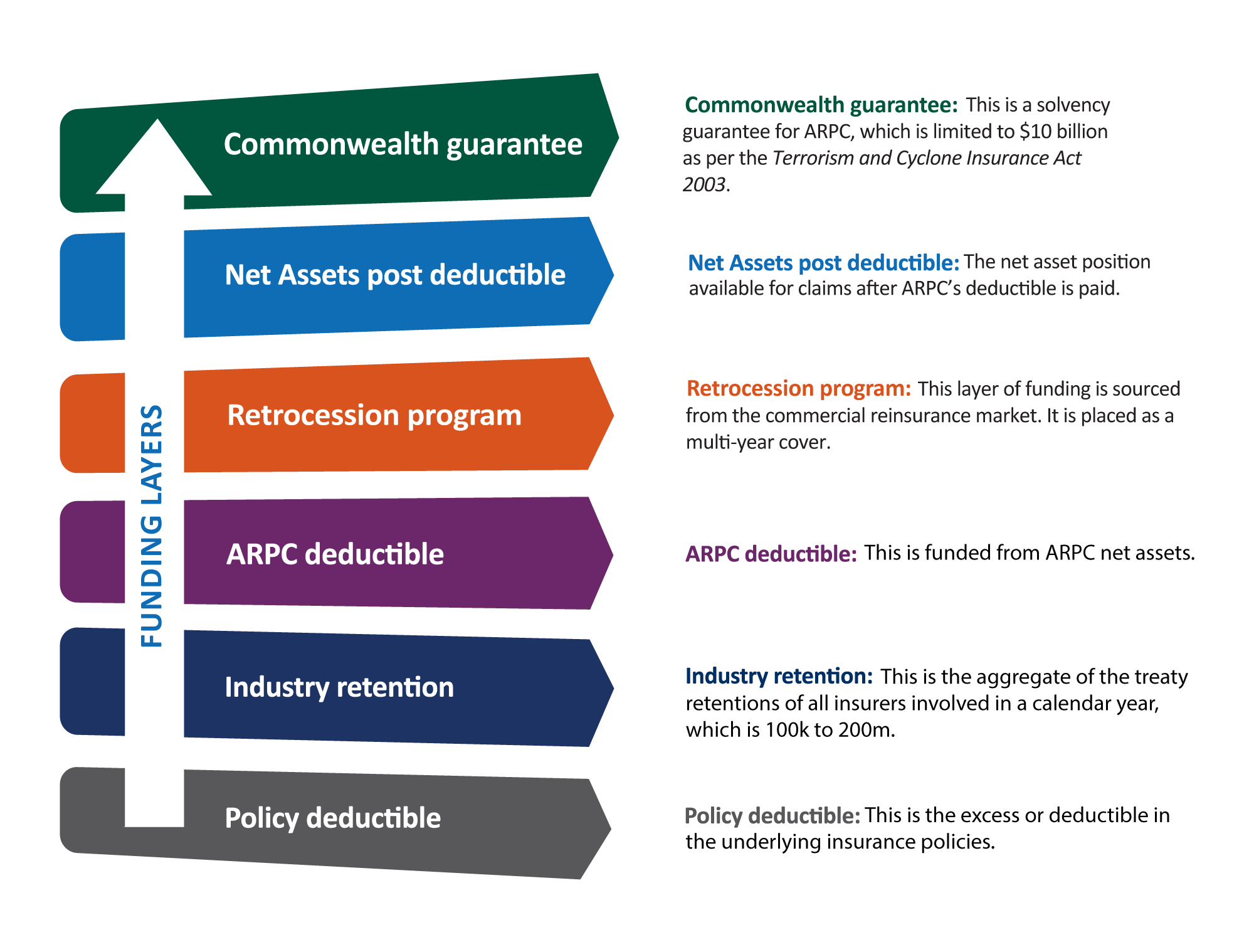

Claims against the terrorism pool are met once an individual insurance company’s retention is exhausted. ARPC’s pool of retained earnings will meet claims until the agreed retrocession deductible is reached. At this point claims are funded by the retrocession program. Once retrocession is exhausted, claims will be met by the Commonwealth guarantee.

The total value of the pool is approximately $14 billion.

Reduction percentage

If the responsible Minister considers that the amount paid or payable under the Commonwealth guarantee will exceed $10 billion, the Minister must also announce a reduction percentage. This will have the effect of limiting the level of cover by reducing the amount payable by the insurer to the policyholder.

Through the terrorism pool, insurers can reinsure the risk of claims for eligible terrorism losses by entering into a Terrorism Reinsurance Agreement (Reinsurance Agreement) with ARPC. Eligible contracts of insurance are defined in the Terrorism and Cyclone Insurance Act 2003 (TCI Act). The policyholders of eligible insurance contracts will be covered for eligible terrorism losses in the event of a declared terrorist incident (DTI), with insurer customers required to meet these claims in accordance with the other terms and conditions of individual policies.

Claims against the terrorism pool are met once an individual insurance company’s retention is exhausted. ARPC’s pool of retained earnings will meet claims until the agreed retrocession deductible is reached. At this point claims are funded by the retrocession program. Once retrocession is exhausted, claims will be met by the Commonwealth guarantee.

The total value of the pool is approximately $14 billion.

Reduction percentage

If the responsible Minister considers that the amount paid or payable under the Commonwealth guarantee will exceed $10 billion, the Minister must also announce a reduction percentage. This will have the effect of limiting the level of cover by reducing the amount payable by the insurer to the policyholder.