Purpose

The Cyclone Reinsurance Pool (cyclone pool) is an arrangement between ARPC and your insurer. It is designed to reduce insurance premiums for households, small businesses, and residential and commercial strata, with medium and high cyclone and related flood damage risk by reducing the cost of reinsurance. It can do this because it is a government entity and offers lower reinsurance premiums than the commercial market does. Paying less for reinsurance reduces costs for insurers so they can pass savings onto their policy holders.

The cyclone pool and the terrorism pool operate differently. This page covers the cyclone pool. Refer to the terrorism pool page for information on the operation of the terrorism pool.

Is my insurer required to join the cyclone pool?

Eligible insurers are required to buy reinsurance through the cyclone pool to cover claims for cyclone events.

A full list of participating cyclone pool insurers is available on this website.

What areas does the cyclone pool cover?

The cyclone pool is an arrangement between your insurer and ARPC, and does not impact a claim with your insurer. It is a reinsurance arrangement that operates Australia-wide but targets pricing support to cyclone-prone areas, which are mainly in northern and western Australia and covers the following types of property:

- Residential home and contents, including landlord insurance and farm residential buildings

- Commercial property policies with maximum sum insured of $5 million or less across risks covered by the cyclone pool (property, contents, and business interruption)

- Residential strata, where the insured is a body corporate and 50 per cent or more of floor space is used mainly for residential purposes, including mixed-use strata schemes with owner-occupied, short-term and/or long-term rental apartments.

Who monitors savings from the cyclone pool?

The Australian Competition and Consumer Commission (ACCC) monitors insurance premiums that insurance companies charge consumers to ensure savings are passed on to policyholders.

Who has to join the cyclone pool?

The cyclone pool is a reinsurance arrangement between insurers and ARPC. Participation in the cyclone pool is mandatory for Australian general insurers that have exposure to cyclone risk in their portfolio. Policyholders do not join the cyclone pool and continue to choose their insurer as usual.

What happens when there is a cyclone?

If you have been impacted by a cyclone and you have an existing insurance policy, you should consider lodging a claim with your insurer. Insurers manage and settle policyholder claims in accordance with the terms, conditions and exclusions of their underlying policies. If you are uninsured, you are not covered by the cyclone pool.

How do policyholders make an insurance claim following a cyclone?

After a cyclone or other extreme weather, policyholders should consider these steps if they have been impacted:

- Lodge a claim with your insurer

If you have an existing policy, contact your insurer as soon as possible so they can give you advice on what to do next. You should be able to do this online or by telephone. You do not need to know the full extent of the damage to get the claims process started, but you should know the date and time of damage, to the best of your knowledge. - Make the property safe

After you have received advice from your insurer, document the damage to your property by taking photos or a video. You can then start the clean-up process and make the property safe. Your insurer may offer support to remove any hazards and prevent further damage. - Assess the damage

Your insurer may appoint someone to inspect the damage to your property and what caused it or ask you for supporting information on the claim. - Making a claim decision

Your insurer will assess your claim and make its decision to accept or decline it, based on the provisions in your policy. If the claim is accepted, in some cases, your insurer may develop a ‘Scope of works’ document outlining what repair and rebuild work will be carried out. Read this document carefully and make sure you agree with it. The scope of work may need to be revised once the repairs start if other damage is found. - Settle the claim

If the claim is accepted, your insurer will offer to either manage a repair / rebuild your damaged property or give you a cash settlement so you can arrange the repairs yourself.

When does ARPC reimburse insurers for claims costs?

ARPC reimburses insurers. This is a separate process and does not impact settlement of your claim and does not affect your claims experience.

Insurers with an ARPC cyclone pool Reinsurance Agreement seek recovery for the cost of claims occurring during a Declared Cyclone Event from ARPC, provided these claims are settled in accordance with the original policy terms, conditions, and exclusions.

ARPC reviews all insurer requests for reimbursement to ensure they are valid under the terms of its reinsurance agreement with the insurer and the Terrorism Cyclone Insurance Act. This process is between ARPC and your insurer and does not impact your claim.

ARPC recognised risk mitigation discounts

You can increase the resilience of your property by implementing risk mitigation measures. Below is a list of ARPC’s recognised risk mitigation measures for homes and strata. For further information you can also refer to the ‘Reducing risks to your property - need help? section.

Mitigation discounts for homes

| Mitigation | Discount applied to wind component of the cyclone pool premium (%) |

| New roof | 30% |

| Roof tied down | 20% |

| Roller door braced | 8% |

| Window protection | 10% |

Mitigation discounts for strata

| Mitigation | Discount applied to wind component of the cyclone pool premium (%) |

| Roof mitigation – full retrofit | 10% |

| Window protection – permanent protection | 3% |

| External doors – cyclone resilient | 3% |

| Vehicle access doors – compliant with current standards on low rise buildings | 3% |

| Gutter overflows – installed for boxed eaves and gutters | 3% |

Will my insurance premiums go down if I make changes to my property?

Insurers may receive discounts on their reinsurance premiums from the cyclone pool if the properties they cover have implemented the recognised mitigants, and they report this to ARPC. The insurer decides how this is then passed on in the price they charge the policyholder.

Reducing risks to your property - need help?

It is important to understand the weather-related risks in your area. This knowledge can help you take actions to reduce the risk of damage to your home, make your property more resilient, and potentially lower the premium charged by your insurer.

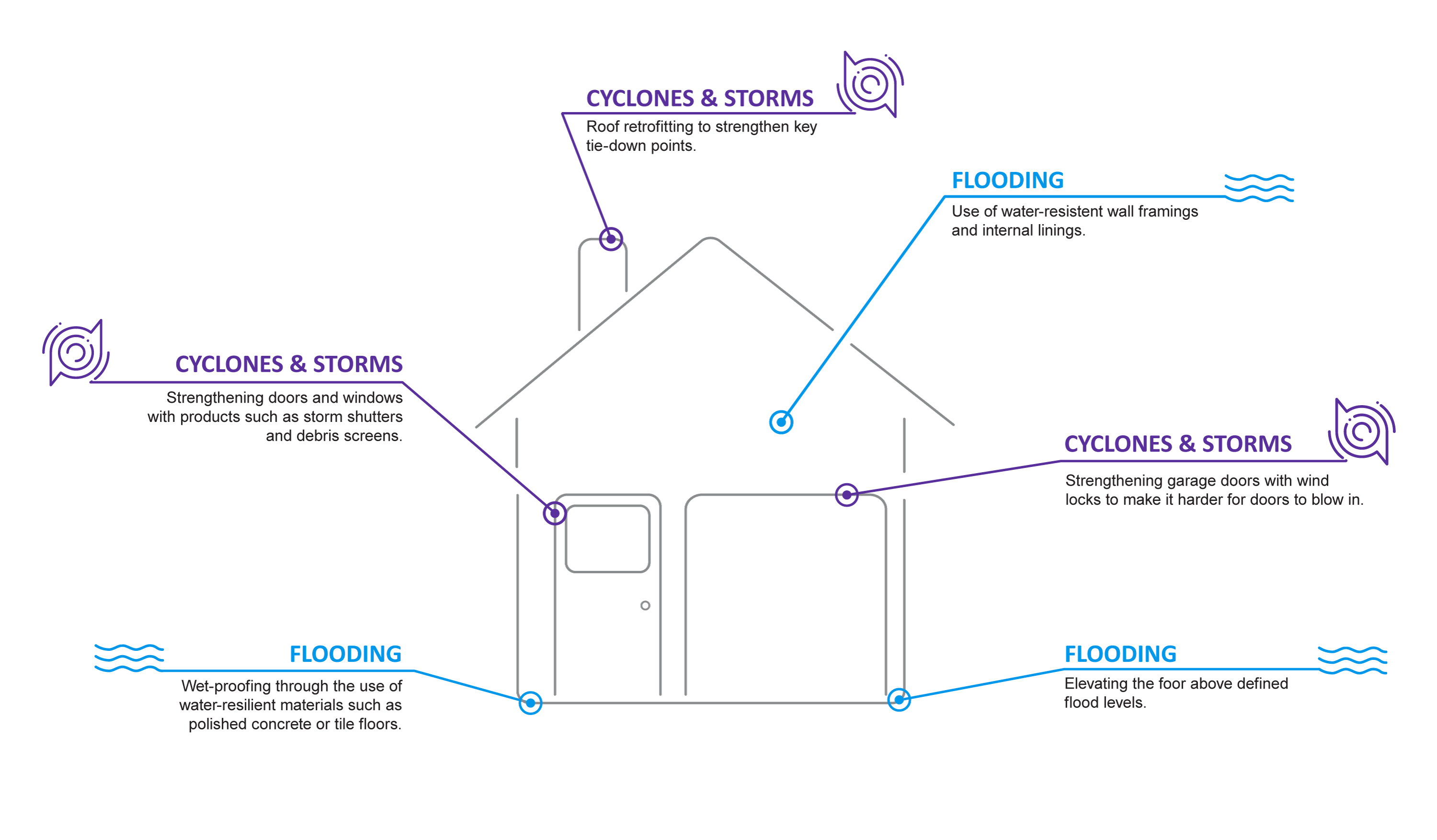

Some high level measures to increase the resiliency of your property to cyclones and flooding may include:

- Strengthening doors and windows with products such as storm shutters and debris screens.

- Strengthening garage doors with wind locks that make it harder for doors to blow in.

- Roof retrofitting to strengthen key tie-down points.

- Elevating the floor above defined flood levels.

- Wet-proofing through the use of water-resilient materials such as polished concrete or tile floors.

- Use of water-resistant wall framings and internal linings.

For more information, National Emergency Management Agency (NEMA) has natural hazard awareness factsheets that provide detailed advice on building, maintaining and insuring your home to help you reduce your cyclone and flood risk.

NEMA also has a range of resources to help you prepare for cyclone or floods that may occur after a cyclone. Visit the National Resilience Action Library to find information specific to your state and property type.

In addition, you can visit the following state and territory government or emergency service websites to help you prepare for cyclones or other extreme weather such as floods.

Please note, ARPC is not responsible for these external websites.