Terrorism pool fact sheet

Purpose of the terrorism pool

The terrorism pool provides insurer customers with reinsurance for commercial property and associated business interruption losses arising from a declared terrorist incident.

Through the terrorism pool, insurance companies can choose to reinsure the risk of claims for eligible terrorism losses by electing to purchase terrorism reinsurance from ARPC. Consequently, holders of eligible insurance contracts will be covered in the event of a declared terrorist incident, with insurers required to meet these claims in accordance with the other terms and conditions of individual policies.

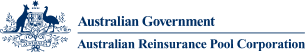

Claims against the terrorism pool are paid once an individual insurance company’s total claims exceed its risk retention. ARPC’s pool of retained earnings will meet claims until the agreed retrocession deductible is reached. At this point, claims are funded by the retrocession program. Once retrocession is exhausted, claims will continue to be met by the Commonwealth guarantee. The total capacity of the terrorism pool is just under $14 billion (as at January 2022).

If the responsible Minister considers that the amount paid or payable under the Commonwealth guarantee will exceed $10 billion, the Minister must also announce a reduction percentage. This will have the effect of limiting the level of cover, by reducing the amount payable by the insurer to the policy holder.

Background of the terrorism pool

The TCI Act was originally established following the withdrawal of terrorism insurance cover by the private insurance market after the 11 September 2001 terrorist attacks in the United States. The Australian Government was concerned that the lack of comprehensive insurance cover for commercial property or infrastructure would lead to a reduction in financing and investment in the Australian property sector.

The TCI Act

The TCI Act overrides terrorism exclusion clauses in eligible insurance contracts, enabling coverage of eligible terrorism losses arising from a declared terrorist incident. The Act requires that a review be conducted at least once every five years that examines the need for the Act to continue in operation.

Terrorism incident declarations

The Minister is required to officially announce a declared terrorist incident before the provisions within the TCI Act can be triggered.

Retrocession

ARPC purchases retrocession capacity to protect the Commonwealth guarantee against small to medium sized losses. The retrocession program also encourages private market participation by Australian and global reinsurers to cover private commercial business assets on Australian soil.

Premiums

The premium charged by ARPC for terrorism reinsurance is determined by Ministerial Direction.

Reinsurance premiums charged by ARPC vary by location and are listed as 2.6 per cent of the premium for eligible policies in Tier C (mostly rural areas), 5.3 per cent of premium in Tier B (mostly suburban areas) and 16 per cent of premium in Tier A (most major city Central Business Districts).

Terrorism pool coverage

Eligible property includes commercial and industrial buildings, mixed-use buildings with a floor space of at least 20 per cent used for commercial purposes, and high-value buildings with a sum insured of at least $50 million, whether used for commercial or other purposes. Coverage includes fixtures, the contents within those buildings and associated business interruption. Eligible property also includes commercially owned infrastructure such as roads, tunnels, dams, railways, and pipelines as well as sites covered by a construction policy. Farms can also obtain cover if they hold insurance against business interruption.

An eligible terrorism loss does not include a loss or liability arising from the hazardous properties of nuclear fuel, material, or waste.

The terrorism pool also covers declared acts of terrorism described as “chemical”, “biological”, “polluting”, “contaminating”, “pathogenic”, “poisoning”, or words of similar effect.

Funding the terrorism pool

ARPC’s premiums are used to fund its operations and build the claims reserve available to meet future claims.

Government support

The terrorism pool is supported by a $10 billion Government guarantee.

Claims

Claims against the terrorism pool will be reimbursed to the insurer as per the Reinsurance Agreement with ARPC.

Important term

Reinsurance: Insurance for insurers – for example, to make sure they can pay many claims in a natural disaster, or to cover situations where they experience claims from policyholders that are higher than a certain value. ARPC operates a reinsurance pool for declared terrorist incidents and a separate pool for declared cyclone events.

Contacts and further information: This fact sheet is designed to provide media representatives with relevant information on the terrorism pool. For further information, please contact [email protected] or Alexander Drake, Head of Public Affairs on + 61 2 8223 6777