ARPC’s 2024-25 Annual Report

Australian Reinsurance Pool Corporation has published its Annual Report Plan for the 2024-25 financial year.

This year’s report highlights our continued commitment to improving the accessibility and affordability of insurance for the Australian community through the terrorism and cyclone reinsurance pools.

The report outlines our strategic priorities, operational performance, financial results, and stakeholder engagement activities. It also details our progress against the 2024–28 Corporate Plan and introduces our forward-looking 2025–29 strategy.

Key achievements include:

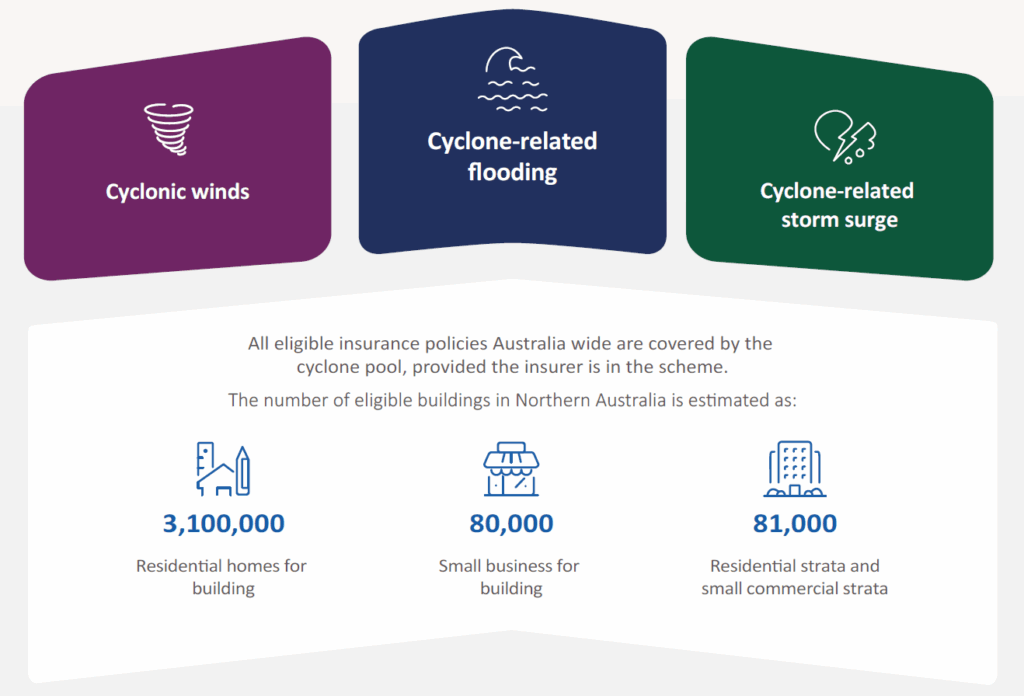

- successfully onboarding all mandated insurers to the cyclone pool

- paying over $130 million in cyclone-related claims, with an average payment time of 11 business days

- observing measurable reductions in insurance premiums in high-risk areas, with up to 39% savings for home policyholders

- publishing five statistical reports and hosting two industry seminars to share insights and foster collaboration

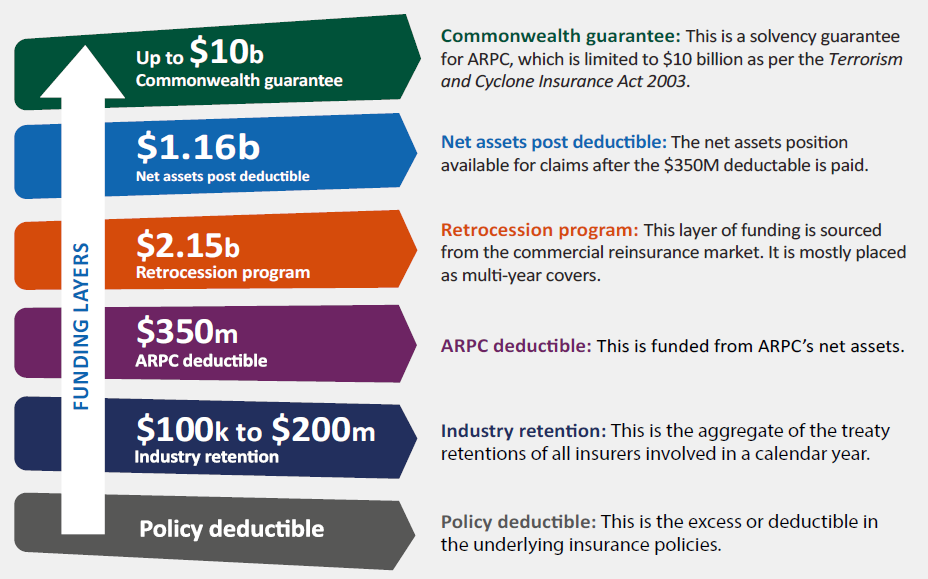

- maintaining strong financial resilience, with all obligations met from ARPC’s own assets.