ARPC is a public financial corporation established on 1 July 2003 under the Terrorism Insurance Act 2003 (TI Act) to administer the terrorism reinsurance pool (the pool). It was established following the terrorist attacks in the USA on 11 September 2001. After this event, there was a global withdrawal of terrorism insurance cover, leaving commercial property in Australia uninsured against terrorist attacks. This market failure reduced access to project funding and commercial refinancing which financially threatened some sectors of the Australian economy.

The TI Act prescribes the function of ARPC, which is to provide insurance cover for eligible terrorism losses (whether by entering into contracts or by other means) and any other functions prescribed by the regulations.

ARPC was established by the Australian Government with the support of stakeholders in the property, banking, insurance and reinsurance sectors.

Under the Public Governance, Performance and Accountability Act 2013 (PGPA Act), ARPC is classified as a corporate Commonwealth entity. This classification means that ARPC is subject to the financial and non-financial reporting requirements of the PGPA Act.

Vision, Mission and Values

ARPC expresses its purpose through its vision and mission.

ARPC remains true to the pool’s original policy objectives and is focused on creating greater value for stakeholders.

To deliver on the Vision and Mission, ARPC strives for a collaborative and high-achieving culture underpinned by integrity, personal leadership and professional development.

These values support the strategy and are fundamental to the success of the organisation. These values also support the ARPC Code of Conduct.

Strategic context

Addressing market failure

ARPC addresses market failure in the Australian commercial property terrorism insurance market through risk sharing and mitigation.

After 18 years of the Pool and ARPC’s operation, a whole-of-market, sustainable, alternative provider of terrorism reinsurance does not exist in Australia or the global market, such that partial market failure still exists. The global reinsurance market has insufficient capacity to offer uniform terrorism risk insurance coverage to the Australian market at affordable prices, a situation unlikely to change in the near term.

The 2018 Triennial Review1 concluded that there continues to be partial market failure and recommended that the Act remain in force and that the pool remain in place. The Review stated: “In the absence of the Act there would likely be a market failure in the terrorism insurance market with wider economic implications.

The estimated global commercial market capacity available for Australian terrorism reinsurance is considered short of the level required to cover against large, but possible, terrorism incidents. Several reinsurers have indicated they would find it difficult to participate in the Australian terrorism insurance market without a mechanism like the ARPC.”

The 2018 Triennial Review report estimates that terrorism risk reinsurance coverage available at reasonable prices to Australian insurers totals around $4 billion, well below the $13.6 billion of reinsurance cover provided by the Pool in 2018.

1The TI Act is reviewed every three years by The Treasury to assess the level of market failure and the need for ARPC to continue.

International threat environment

The international threat environment for terrorist events has changed dramatically in recent years. Terrorist attacks in Christchurch, London, Manchester, Paris, Sri Lanka, and Melbourne show an increase in the frequency of terrorism. There has also been a growing trend where perpetrators of terrorist acts are individuals who have not previously been on the authorities’ radar, but who are unstable and susceptible to rapid radicalisation.

COVID-19 has seen a reduction in terrorism activity in western economies due to lockdowns and restricted movement. However, the period has seen an increase in online radicalisation, which will heighten the risk of future attacks. Internationally and in Australia, a significant number of terrorists serving sentences for crimes committed earlier in the century are being released from prison.

Many individuals are not reformed. There has also been an increase in extreme right-wing groups and individuals. These groups and individuals have been displaying increasingly violent rhetoric.

Australian threat context

Australia has seen several terrorist incidents prevented, including lone-perpetrator actions, the attempt to load a chemical bomb onto an aircraft departing Sydney, and a plot to use an improvised explosive device to disrupt an electrical substation on the New South Wales south coast.

Australia is experiencing an increase in extreme right-wing activity, with 40 per cent of counter terrorism cases now involving right-wing extremism. Extreme right-wing terrorists are more likely to target institutions than individuals, and subsequently the commercial property covered by the ARPC pool has a heightened risk of being targeted.

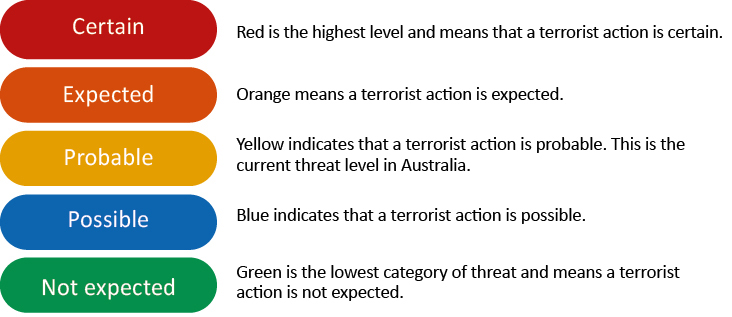

The National Terrorism Threat Advisory System (NTTAS), launched by the Australian Government on 26 November 2015 to inform the public about the likelihood of an act of terrorism occurring in Australia, shows our 2020-21 NTTAS threat level as Probable, reflecting the intelligence assessment by the National Threat Assessment Centre. NTTAS has five levels to indicate the national threat level as shown in National Terrorism Threat Advisory System . Probable means credible intelligence, as assessed by security agencies, indicates individuals or groups have developed the intent and capability to conduct a terrorist attack in Australia. The current level has not been introduced in response to a specific threat.

For more information on the National Terrorism Threat Advisory System and the current level of alert, please visit: www.nationalsecurity.gov.au/Securityandyourcommunity/Pages/National-Terrorism-Threat-Advisory-System.aspx

Strategic priorities

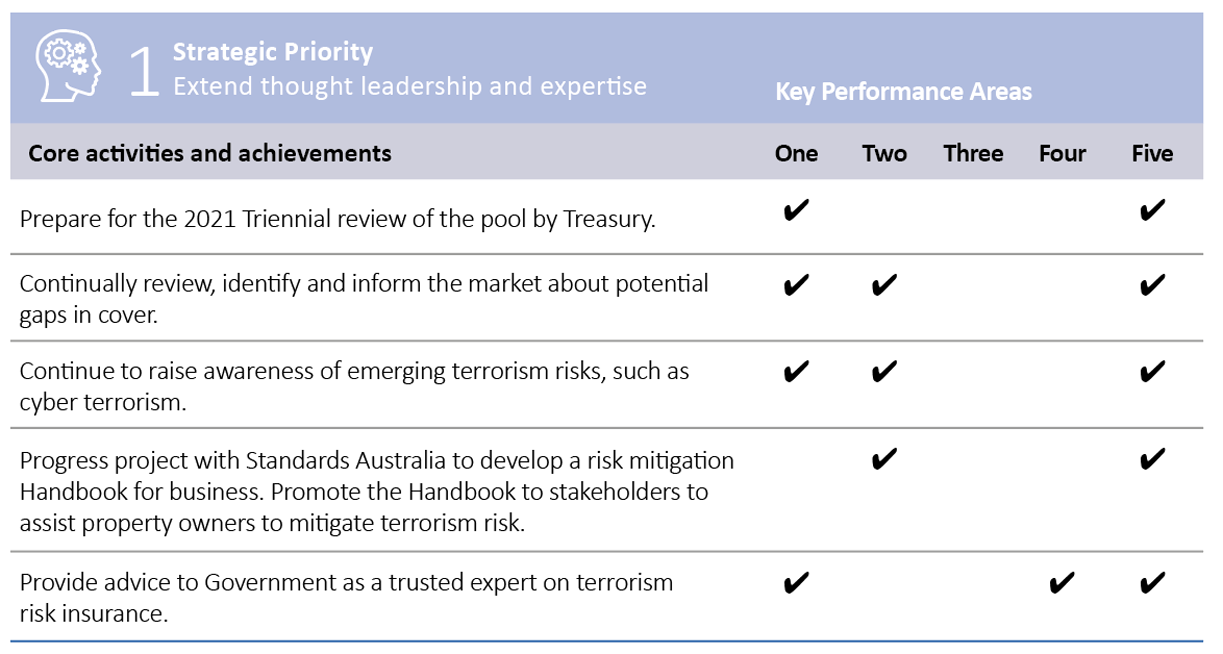

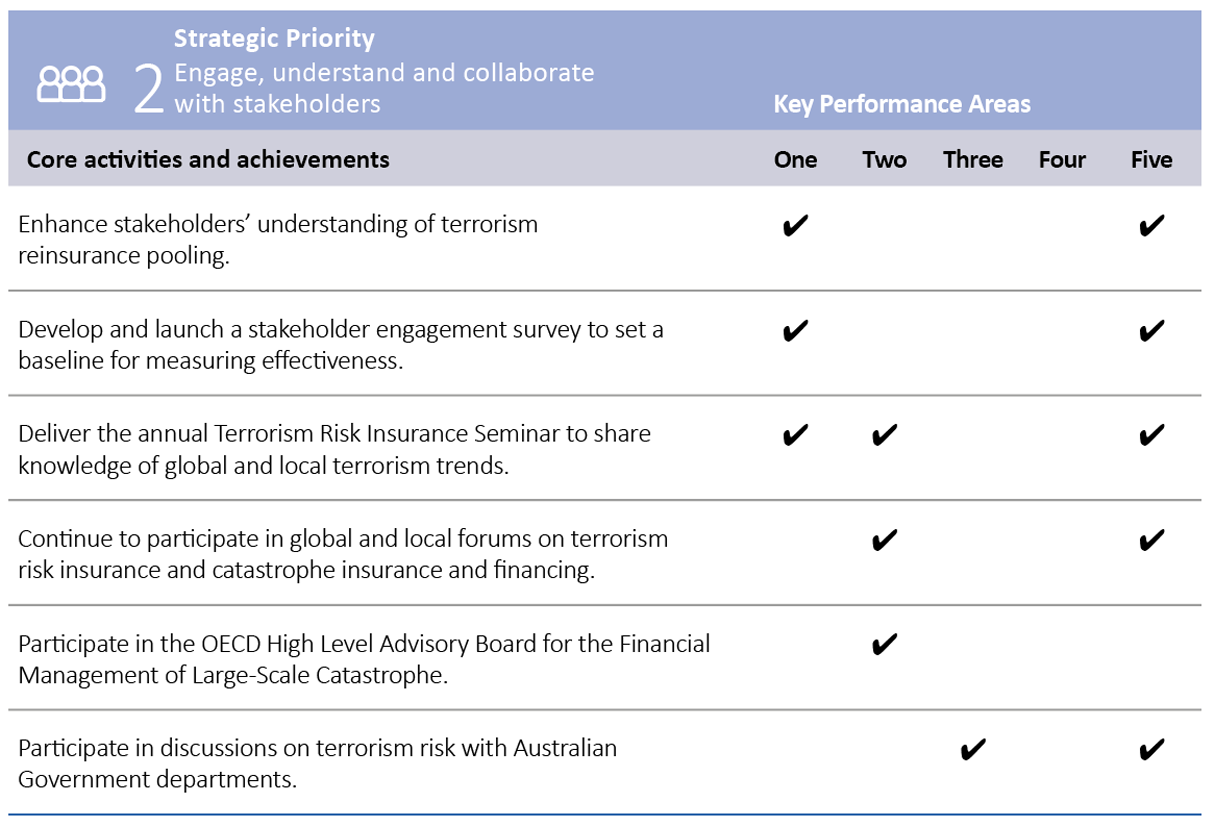

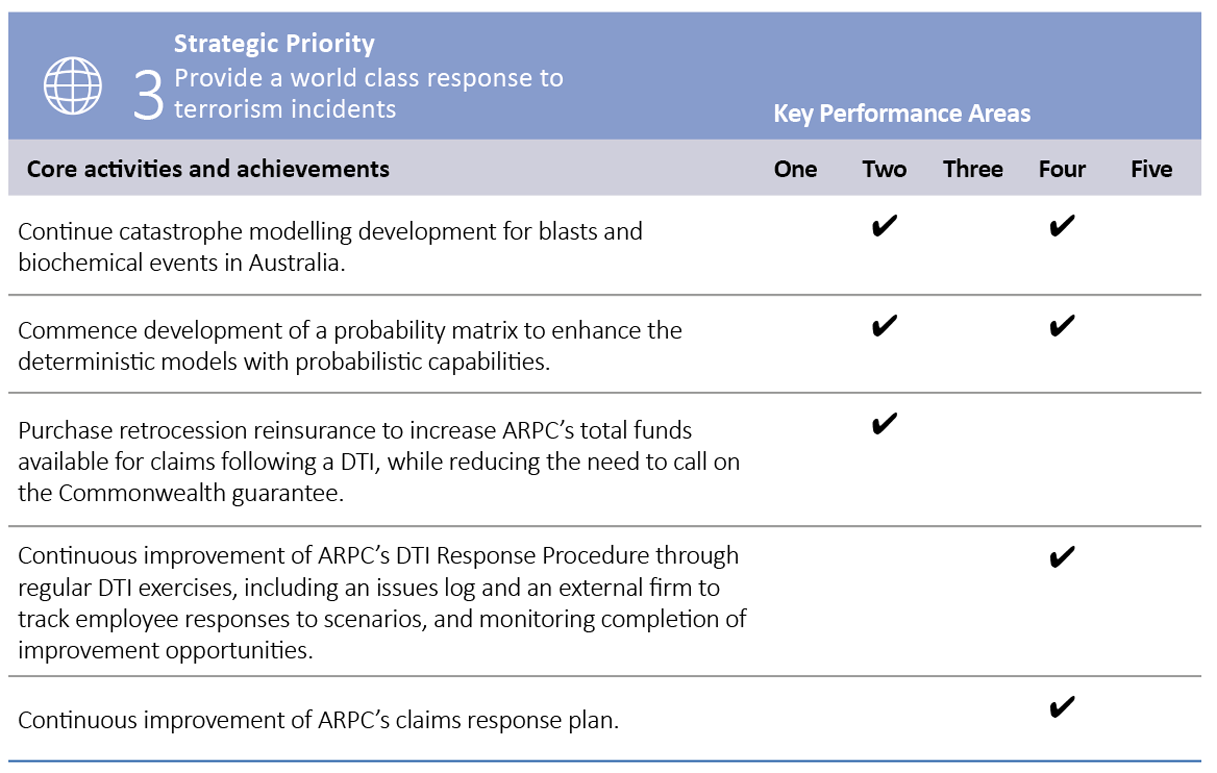

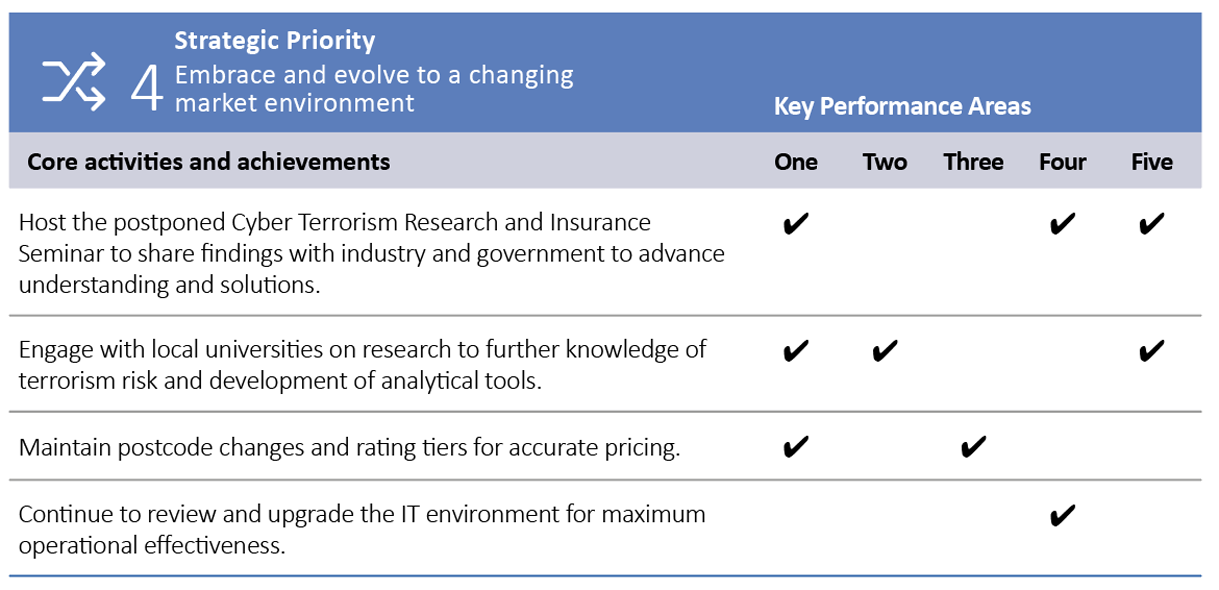

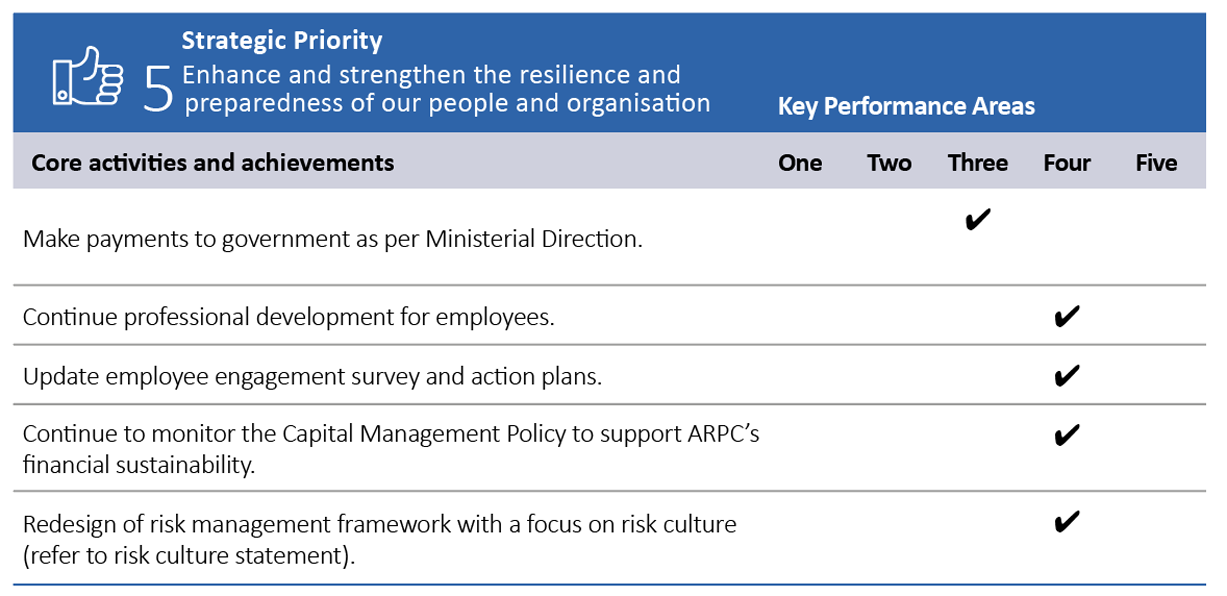

ARPC’s 2020-24 Corporate Plan set out five strategic priorities based on business objectives.

Progress against the 2020-24 Strategic Priorities

ARPC made progress against all five strategic priorities outlined in the 2020-24 Corporate Plan in the following five key performance areas:

One: Providing reinsurance for eligible terrorism losses

Two: Encouraging private sector participation through retrocession

Three: Compensating the Government

Four: Maintaining financial sustainability and organisational resilience, and

Five: Engaging, understanding, and collaborating with stakeholders.

Activities undertaken to progress ARPC’s strategic priorities in these key performance areas are detailed below.

Activities undertaken to progress ARPC’s strategic priorities

Working with ARPC stakeholders

ARPC is committed to timely, open communication with stakeholders and strives to understand their needs, meet their expectations, and deliver additional value.

During 2020-21, ARPC continued to develop and sustain stakeholder relationships. Regular meetings were held with insurers, major commercial property owners, relevant state and Australian Government agencies and industry associations. ARPC also provided customer advice on reinsurance agreements and insurer premium submissions.

Activity-based metrics

Face-to-face meetings were held during the reporting period with the following stakeholders:

- insurer customers

- global reinsurers

- industry bodies

- Australian Government representatives at local, state and federal levels, and

- state insurance corporations

ARPC also engaged in other stakeholder activities including:

- ARPC events such as our online market briefing (Sydney) for the 2021 retrocession program, our Cyber Terrorism Research and Insurance Webinar, our annual Terrorism Risk Insurance Webinar, and a stakeholder networking function in Canberra

- insurer customer review program

- electronic direct mail distribution of our quarterly newsletter Under the Cover

- LinkedIn posts

- website, and articles in insurance industry publications.

Outcomes-based metrics

In 2020-21, ARPC launched its inaugural stakeholder engagement survey. This survey, which establishes a benchmark for future surveys, was designed to answer the following big questions:

- Is ARPC delivering to its vision?

- What is stakeholder sentiment towards ARPC?

- Does ARPC provide value for money?

- Is ARPC’s engagement effective?

More information, including the results of activity and outcome-based metrics on stakeholder engagement can be found in 5. Engage, understand and collaborate with stakeholders .

Knowledge sharing

ARPC believes that sharing knowledge with stakeholders enhances existing relationships and helps to develop a better understanding of ARPC, the TI Act, and the environment in which ARPC operates.

During 2020-21, ARPC representatives attended various industry forums (many this year were online due to COVID-19) as delegates and presenters, to share information and ideas.

Retrocession renewal discussions also provided an opportunity for ARPC to present the latest information on Australian terrorism risk and the results from the portfolio risk analysis, including blast and plume catastrophe modelling outcomes.

ARPC’s insurer customer review program is an integral part of ARPC’s stakeholder engagement efforts. The program takes a collaborative approach, educating insurer customers about the requirements and function of the pool to generate increased compliance. The program also provides an opportunity to share insights into the contemporary terrorism landscape and provide information on the strategic projects ARPC is undertaking. During 2020-21, the team used a combination of remote reviews and onsite reviews as permitted by the pandemic.

Communications and publications

ARPC publishes a quarterly digital newsletter called Under the Cover aimed at insurer customers and other subscribers to provide information relating to reinsurance cover with ARPC. This includes postcode updates for reporting exposures and other information regarding reinsurance agreement obligations.

ARPC also uses Electronic Direct Mail (eDMs) to communicate with insurer customers about changes to the pool, deadlines for returns or submissions and any other relevant information.

ARPC has a company LinkedIn page to share announcements, event coverage and other news with our stakeholders.

Our website is a repository for information about the pool and how it operates, as well as for annual publications, quarterly newsletters, research papers, media releases, events and Q&As.

Industry involvement

ARPC engages with the Australian and international re/insurance industries through various forums. Participation in industry events raises stakeholder awareness of the pool and provides an opportunity for stakeholders to stay informed about global developments in terrorism risk and insurance. During 2020-21, ARPC attended industry conferences and events including (but not restricted to):

- ANZIIF General Insurance virtual breakfast

- ANZIIF RISC Reimagined, ANZIIF’s reinsurance study course

- Career Trackers Gala event awards (online)

- AICD – Australian Governance Summit

- ARPC stakeholder dinner Canberra

- ARPC Cyber Terrorism Research and Insurance webinar

- ARPC Terrorism Risk Insurance Webinar

- Cybersecurity Taskforce Webinar – Capacity Building for Resilience

- ASPI webinars

- Dragoman virtual seminar

- IFTRIP LIVESTREAM

- IFTRIP Pools call

- APS200 event

- Dragoman dinner event

- Australian Bankers’ Association – Natural Disasters Seminar

- MunichRe cocktail event

- Finity Director Forum

- Aon Impact Forecasting Revealed 2021

- Property Council Chief Risk Officer Roundtable

- OECD-ADBI Roundtable on Insurance and Retirement Saving in Asia

ARPC engages with global terrorism pools

ARPC’s stakeholder engagement strategy includes developing links with peer terrorism pools overseas to share knowledge and experience. The key channel for this type of engagement is membership of the International Forum of Terrorism Risk (Re)Insurance Pools (IFTRIP), an organisation of national terrorism pools.

The 2020 IFTRIP annual conference was converted to a virtual event due to the COVID-19 pandemic. In October 2020, more than 800 delegates from around the world tuned into IFTRIP LIVESTREAM.

ARPC CEO and IFTRIP President, Dr Christopher Wallace, presented on the topic, ‘Beyond Terrorism: How do we reinforce the Re?’, which highlighted similarities between terrorism and pandemics. As is usually the case, the open conference was preceded by a one-day closed terrorism pool meeting. This was followed by the main conference which brings together sovereign-backed terrorism reinsurance pools, industry experts and the wider counter terrorism community.

IFTRIP was formally ratified at the ARPC-OECD Global Terrorism Risk Insurance Conference in Canberra in 2016. Subsequent IFTRIP annual conferences have been held in Paris (2017), Moscow (2018) and Brussels (2019).

The following institutions are members, observers or invitees of IFTRIP: Australia (ARPC); Austria (GRAWE); Belgium (TRIP); Denmark (FINANSTILSYNET); France (GAREAT, CCR); Germany (Extremus); India (GIC); Israel (ITC); Namibia (NASRIA); Netherlands (NHT); Russia (RATIP); South Africa (SASRIA); Spain (CCS); Sri Lanka; UK (Pool Re) and USA (TRIP).

ARPC launches cyber terrorism research findings

ARPC hosted its highly anticipated Cyber Terrorism Research and Insurance Webinar in September 2020, proving digital channels could be just as interactive as ARPC’s pre-COVID-19 seminars.

The webinar was used to formally launch ARPC’s cyber terrorism research project, ‘Insurance Risk Assessment of Cyber Terrorism in Australia’, undertaken by the OECD and the University of Cambridge’s Centre for Risk Studies.

There were 135 webinar attendees whose participation was aided by an open chat box, live polls, and a discussion panel. This was the first time ARPC had hosted a webinar.

The positive feedback highlighted the variety and credibility of the speakers, engaging content and efficient timing.

Speakers comprised:

- Professor Paula Jarzabkowski

High profile insurance academic, author and International Forum of Terrorism Risk (Re)Insurance Pools (IFTRIP) presenter, who chaired the event. - Dr Christopher Wallace

ARPC CEO, who called for clarity (in future triennial reviews of the ARPC pool), on the computer crime exclusion in the Terrorism Insurance Act 2003 which effectively removes cover for physical property damage and business interruption from acts of cyber terrorism. - Leigh Wolfrom

OECD Policy Analyst (Insurance), summarised OECD’s research findings including existing cyber insurance coverage, global pools coverage of cyber and the practicalities of expanding ARPC’s Pool to include cyber terrorism. - Simon Ruffle

Director of Research & Innovation, Centre for Risk Studies, Cambridge Judge Business School, University of Cambridge, provided an overview of Cambridge’s research findings including plausible scenarios and potential economic and insured losses from cyber terrorism.

ARPC hosts terrorism risk and insurance Webinar

At ARPC’s annual Terrorism Risk and Insurance Webinar, ARPC CEO, Dr ChristopherWallace and Chief Underwriting Officer, Michael Pennell PSM, gave an overview of the terrorism landscape, including the threat posed by the extreme right wing (XRW).

XRW groups constitute 40 per cent of counterterrorism caseloads nationally, up from 10-15 per cent of cases before 2016.

The Webinar took place on 12 November 2020 after being converted to a webinar due to COVID-19 restrictions on mass gatherings.

Chris Holt MBE and Jerry Smith OBE from CHC Global in the United Kingdom, delivered an insightful presentation on chemical, biological and radiological (CBR) threats using the 2018 Salisbury novichok poisonings as a case study.

This was followed by Dr Ryan Crompton, Managing Director of Risk Frontiers, who presented a response to the Federal Government’s 2020 Cyber Security Strategy.

More than 200 industry professionals registered for ARPC’s live event, with an additional 262 requesting a recording.

More than 80 per cent of attendees rated the overall presentation skills of the speakers as Excellent, with many commenting on their expertise and ability to relate issues back to the wider insurance space.

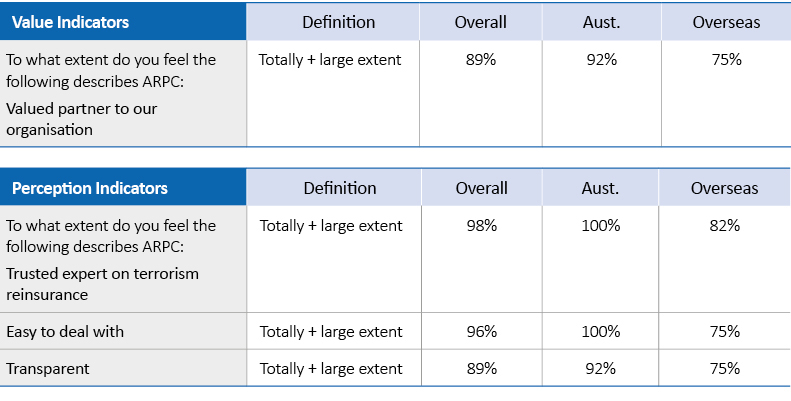

ARPC is a ‘valued partner’ customer survey finds

ARPC is delivering on its vision, is a valued partner, a trusted expert and is communicating and engaging well with stakeholders, according to ORIMA Research’s inaugural annual survey of ARPC’s insurer customers.

Survey results indicated that ARPC is considered to be a trusted provider of terrorism insurance.

Insurer customers (Australian and overseas) called ARPC expert, efficient, trustworthy and valuable when asked to describe the organisation in a couple of words.

Pleasingly, 92 per cent of Australian respondents and 75 per cent of overseas respondents saw ARPC as a valued partner to their organisation.

ARPC’s publications and digital business-to-business communications were rated strongly, and insurer customer reviews were well regarded by customers.

Based on survey feedback, there are opportunities for ARPC to provide further technical information on terrorism insurance through its website, as well as face-to-face meetings.

The survey also revealed Australian respondents (who account for 90 per cent of ARPC’s premium income) are more engaged with ARPC than overseas respondents.

Context

In ARPC’s 2020-24 Corporate Plan, ARPC said it would develop and launch an annual insurer customer survey to set a baseline for measuring stakeholder engagement effectiveness and to improve stakeholder outcomes.

Methodology

The survey design was guided by a senior executive workshop which identified several ‘Big questions’: Are we delivering on our vision? What do our customers think of us? Does ARPC represent value for money? Does ARPC engage effectively with stakeholders?

Conducted by ORIMA in November and December 2020, the short online survey was sent to the primary contact for ARPC’s 225 insurer customers, 36 of which are based in Australia and 189 based overseas. Responses were received from 63 insurer customers (28 per cent), including 12 of 36 Australian insurer customers (33 per cent) and 51 of 189 overseas insurer customers (27 per cent).

ORIMA noted that the response rates for the survey are within the typical range for surveys like this and that the general pattern of results are a reasonable indicator of the views of insurer customers.

Next steps

ARPC thanked insurer customers for their strong overall support of ARPC in the inaugural survey.

ARPC has committed to an annual insurer customer survey to gather feedback and make continuous improvements which benefit customers.

The full survey report is published on the ARPC website at arpc.gov.au/publications/media-releases/

ARPC supports Standards Australia risk mitigation handbook

In 2018, ARPC submitted a proposal to peak standards development body, Standards Australia, for the development of a handbook to support proactive risk management for deliberate acts of physical damage to large-scale infrastructure (commercial buildings).

Australian industry stakeholders and representative bodies across insurance, commercial property, facilities management, events management, local government, fire services and national security supported the proposal and contributed to the drafting of the Handbook.

The working title of the Handbook has recently been updated from ‘Physical Protective Security Treatment for Buildings Handbook’. Now called ‘Base-Building Physical Security Handbook – Terrorism and Extreme Violence’, it will provide guidance to owners and operators of commercial buildings on identifying and assessing relevant sources of building risk associated with terrorism and other deliberate acts of extreme violence (such as civil commotion) and implementing suitable controls to mitigate such risk.

The draft Handbook was opened for Public Comment in April/May 2020. This allowed various stakeholders, including industry professionals and consultants, organisations and other government bodies to review the draft and provide their feedback.

The Drafting Committee met throughout May 2020 and again in April 2021 to address the feedback received during the Public Comment phase and subsequent drafting changes to the Handbook. It is expected the Handbook will be published next financial year.

The Handbook aligns with ARPC’s strategic objectives, particularly to “extend thought leadership and expertise” and to “engage, understand and collaborate with stakeholders”. Over the next few months, ARPC will formulate a plan to officially launch the Handbook with a series of meetings and presentations to insurers and property owners, in the form of a ‘roadshow’.

The roadshow and promotion of this important resource will assist in promoting ARPC as a key advisor in the field of terrorism risk mitigation and allow ARPC to strengthen relationships with key stakeholders.